FlowMaster™ Enigma

Multi Confluence and Time Frame

Real Time Order Flow Analysis

Simple Stops and Take Profits

Home of The Enigma!

Gamify the market.

The edge in your hands.

Automate The Enigma

Full and Semi Automated

Prop Firm Compliant

40ms Execution

Enigma Dream Panel

Confluence Levels 1–4

Quantity Controller

Automated Filters

Home of The Enigma!

Gamify the market.

The edge in your hands.

Our System

Turn Complex Analysis

Into Easy-to-Read Charts.

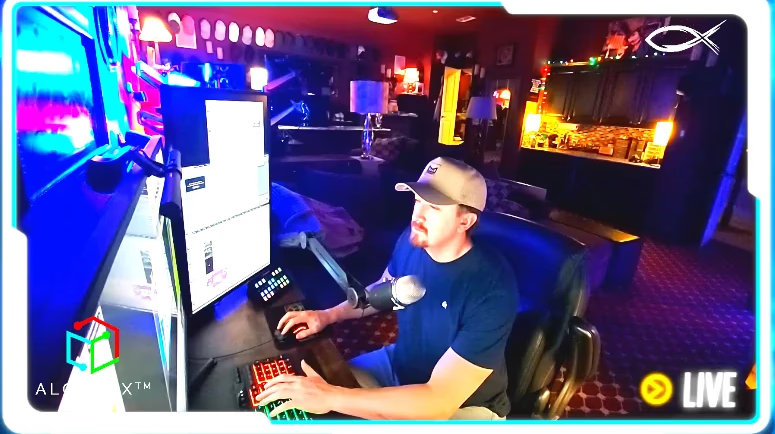

Hear from Traders Using AlgoBox

Be the next Success.

I finally signed up and have been convinced more every day. Thank you Vinny for all your time spent teaching and the entire Algobox team here in Discord. The customer service is also the best and quick to solve any issues you may have!

AlgoBox User

Vinny, the mentorship stream from yesterday was so valuable. You have explained these concepts many times, but how you put it yesterday was some of your best. Thank you!

AlgoBox User

A million thanks to Vinny and team for all your hard work, enthusiasm and professionalism through the years. Thank you for your generosity and support for us all!

AlgoBox User

Whoa. I love volatility. This day is producing some impressive signals. Algobox has me is shock of precision on these signals. And Audiobox, bless you kind sir. Kudos Vinny. You have created a thing of beauty.

AlgoBox User

These AO cluster days were a real challenge they make you feel like it is Opposite Day, really messes with your head game but Vinny helps us see it and what we can see we don't need to fear!

AlgoBox User

I just want to say how much I appreciate this crew. I won't name names because I will forget someone. So many have contributed to my success by contributing valuable content to this room. All because we are associated with Vinny and Algobox.

AlgoBox User

I was doing market replay this morning and I realized, YOU CAN'T BEAT THE ENIGMA. Statistically this thing is unmatched. I'm going to setup and alter and pray to it.

AlgoBox User

Hear from Traders Using AlgoBox

Be the next Success.

I finally signed up and have been convinced more every day. Thank you Vinny for all your time spent teaching and the entire Algobox team here in Discord. The customer service is also the best and quick to solve any issues you may have!

AlgoBox User

Vinny, the mentorship stream from yesterday was so valuable. You have explained these concepts many times, but how you put it yesterday was some of your best. Thank you!

AlgoBox User

A million thanks to Vinny and team for all your hard work, enthusiasm and professionalism through the years. Thank you for your generosity and support for us all!

AlgoBox User

Whoa. I love volatility. This day is producing some impressive signals. Algobox has me is shock of precision on these signals. And Audiobox, bless you kind sir. Kudos Vinny. You have created a thing of beauty.

AlgoBox User

These AO cluster days were a real challenge they make you feel like it is Opposite Day, really messes with your head game but Vinny helps us see it and what we can see we don't need to fear!

GreyWolf

AlgoBox User

I just want to say how much I appreciate this crew. I won't name names because I will forget someone. So many have contributed to my success by contributing valuable content to this room. All because we are associated with Vinny and Algobox.

AlgoBox User

I was doing market replay this morning and I realized, YOU CAN'T BEAT THE ENIGMA. Statistically this thing is unmatched. I'm going to setup and alter and pray to it.

Saibot

AlgoBox User

Hear from Traders Using AlgoBox

Be the next Success.

I finally signed up and have been convinced more every day. Thank you Vinny for all your time spent teaching and the entire Algobox team here in Discord. The customer service is also the best and quick to solve any issues you may have!

AlgoBox User

Vinny, the mentorship stream from yesterday was so valuable. You have explained these concepts many times, but how you put it yesterday was some of your best. Thank you!

AlgoBox User

A million thanks to Vinny and team for all your hard work, enthusiasm and professionalism through the years. Thank you for your generosity and support for us all!

AlgoBox User

Whoa. I love volatility. This day is producing some impressive signals. Algobox has me is shock of precision on these signals. And Audiobox, bless you kind sir. Kudos Vinny. You have created a thing of beauty.

AlgoBox User

I just want to say how much I appreciate this crew. I won't name names because I will forget someone. So many have contributed to my success by contributing valuable content to this room. All because we are associated with Vinny and Algobox.

AlgoBox User

These AO cluster days were a real challenge they make you feel like it is Opposite Day, really messes with your head game but Vinny helps us see it and what we can see we don't need to fear!

AlgoBox User

I was doing market replay this morning and I realized, YOU CAN'T BEAT THE ENIGMA. Statistically this thing is unmatched. I'm going to setup and alter and pray to it.

AlgoBox User